What is the White List of VAT Taxpayers?

On September 1, 2019, the so-called white list of VAT payers. Making it available results from the amendment to the VAT Act of April 12, 2019, the purpose of which is to close loopholes in the tax system.

The act imposes, among others, the obligation to verify the contractor in white list of VAT taxpayers before paying the invoice. This list is nothing more than a unified VAT register, extended with company billing account numbers. The data is updated daily, and the check itself should be performed on the day of the transfer order.

What are the risks of non-compliance with the regulations?

From January 1, 2020, the following sanctions will apply to entities that pay invoices by transfers to accounts that are not on the white list:

- it is not possible to credit the transfer amount above 15,000 PLN to tax deductible costs;

- the risk of joint and several liability with the contractor for tax arrears.

Where can I check the contractor?

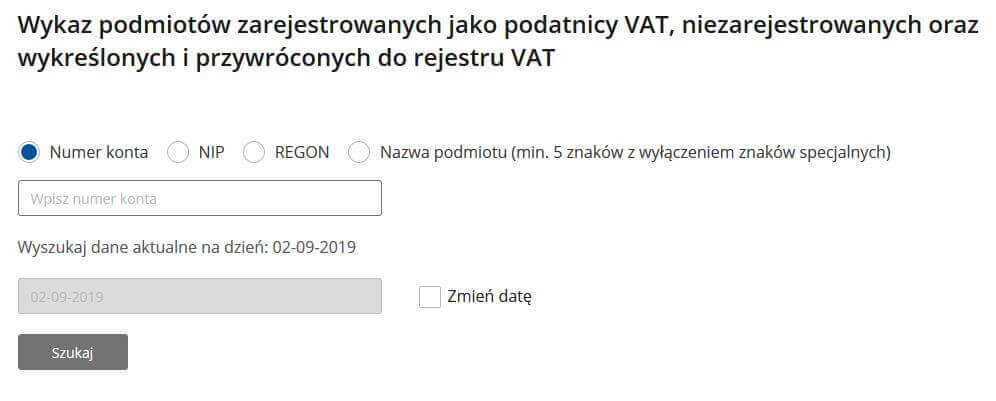

The Ministry of Finance provided 2 methods of accessing this list:

- through the API programming interface, in which only 10 inquiries for a maximum of 30 entities per day will be possible;

- an encrypted text file with a list of taxpayers and bank account numbers, which will be made available in November 2019.

There is, however, one more method of counterparty verification by performing a manual check directly on the website of the Ministry of Finance.

How to comply with the regulations?

The sanctions will apply from January 1, 2020. Entrepreneurs have 3 months to comply with the regulations. One of the possibilities of this is the use of RPA (Robotic Process Automation) technology, specifically by using a tool for creating robots, an example of which is the Polish Wizlink.

Delegating this task for software robots is primarily:

- No need to modify existing processes and applications: the robot will adapt to current processes.

- Working on current data: the robot works on the current list of taxpayers.

- Reporting: the robot will include each check in the report in the event of a tax inspection.